Bidding on large projects is bittersweet. If you have an opportunity to bid on a project that could be either a blessing or a burden, it is important to manage the cash flow. Because cash is King, it has the ability to put you in a castle or a shack. What kind of living quarters you live in can be decided by cash flow. A significant number of companies go out of business because of lack of cash, not a lack of great ideas.

When bidding on large projects there are a few questions that need to be addressed. First, when are the costs of the project due? Second, when will the majority of the labor be needed? Third, what size of a down payment do I need? When do I need progress payments? Most companies think the down payment question should be answered first, but that is not always the case. It is necessary to know when your costs are going out so you know what size your down payment needs to be and when your progress payments need to come in.

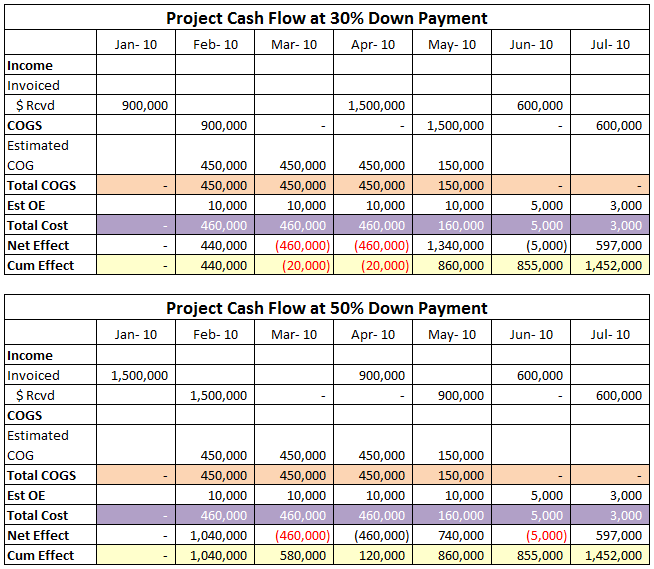

Let’s assume some facts for our example:

- Revenue on the project is $3,000,000

- Cost of Goods Sold (COGS) are $1,500,000

- Operating Expenses are $10,000 for the first 4 months, then gradually less as the project closes

Following the tables listed above, if you change the down payment from a 30% down payment to a 50% down payment, you go from needing $480,000 to not needing any additional cash at all during the entire project. This is assuming a progress payment is scheduled four months into the project.

A spreadsheet like this does not take very much time to set up. By putting in that extra time your company can go from living high on the hog to searching the couch cushions for change.